Compounding: Tiny Investments + Tremendous Returns

Compounding is the process by which savings or investments increase at an accelerated pace over time; similar to a snowball gathering more snow as it rolls downhill, becoming larger and and gaining more mass and momentum with every turn. As we explore the power of compounding in greater detail, we’ll demonstrate how tiny and regular contributions can grow tremendously, and provide actionable tips on how you, together with StorkFund, can harness the compounding effect to secure your financial future.

Key Insights

- Leveraging the power of compounding is an important wealth-generation strategy.

- Time is critical. The sooner you begin saving and investing, and the longer your funds are allowed to compound, the more accelerated your growth and financial returns.

- Prioritizing early and saving proactively to manage your family’s life-cycle expenses supports your long-term retirement savings strategy, enabling you to secure funds needed for your family’s life-cycle expenses without having to prematurely withdraw from your retirement savings.

- Opening a StorkFund to easily and regularly save for your family’s life-cycle expenses alongside the financial support of your employer, transforms your wealth journey and unleashes the exponential cycle of compounding for you and your (future) family.

- Even modest amounts grow significantly over time and it’s never too late to leverage the power of compounding and prioritize financial security for you and your family.

What IS Compounding?

Compounding is the process by which the money you earn is reinvested and generates additional earnings for you.

Picture planting a tree which produces fruits and seeds each year. If you plant those seeds alongside your tree, you’ll have more trees. The new trees planted will produce more fruits and more seeds, each of which will produce even more trees with fruits and seeds. Over time, you’ll have a forest, with an abundance of trees, fruits, and seeds; the consequence of your planting a single tree and planting its seeds as well. That’s the magic of compounding: Like trees producing seeds which produce a forest of more seed-producing trees, your wealth grows exponentially with compounding.

Luckily, whether you’re contributing funds to a savings account (such as StorkFund’s high-yield savings account) or to an investment account (such as StorkFund’s investment account), the simple principle of compounding will significantly accelerate the growth of your contributions.

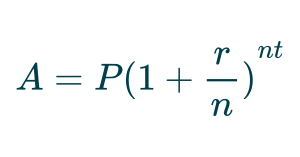

The Simple Math Behind Compounding

It’s not a straightforward formula, perhaps, but the practical conclusion is simple: Even a modest initial investment, with consistent contributions, grows significantly over time.

A = the amount of money accumulated after n years, including interest.

A = the amount of money accumulated after n years, including interest.

P = the principal amount (the initial amount of money).

r = the annual interest rate (decimal).

n = the number of times interest is compounded per year.

t = the number of years the money is invested or borrowed for.

Two important principles, which are critical for maximizing the power of compounding, are embedded in this math.

Start Contributing Early

Let’s consider Alice and Bob.

Alice begins saving at 25, contributing $200 per month into an investment account earning an average annual return of 7%. She stops contributing to her investment account after 10 years, at the age of 35, but allows her money to remain in the account.

Bob, on the other hand, starts saving much later. At the age of 35, Bob begins contributing $200 per month into an investment account, also earning an average annual return of 7%. Unlike Alice, Bob does not stop contributing to his investment account after 10 year; indeed, Bob continues to contribute to his investment account until he is 65.

When Alice and Bob are both 65, whose investment account do you estimate will have the higher value? You may be tempted to believe it will be Bob’s; after all, Bob saved consistently for 30 years, while Alice limited her contributions to the first 10 years of Bob’s 30 years.

The winner is defined by the magic of compounding. Even though Alice limited her contributions to the first 10 years of Bob’s 30-year savings period, Alice’s investment account will be worth approximately $402,000, while Bob’s investment account will be worth approximately $362,000. As a result of Alice’s earlier start, Alice’s funds compounded for 30 years, giving Alice’s investment account a significant edge and ultimately earning Alice substantially more funds than Bob, even though Bob contributed significantly more to his investment account than Alice did to hers.

With the law of compounding in mind, it’s worth asking: Do you want to contribute more (like Bob) or earn more (like Alice)?

Contribute Consistently Over Time

If you began contributing $100 per month to a high-yield savings account, earning interest at a rate of 5% compounded annually, you will contribute $1,200 to your savings account during the first year and earn $60 in interest during the following year. The $60 you earn in interest is essentially free money, and it will begin to accrue interest of its own alongside the funds you have deposited, making you additional money without requiring additional contributions. After 30 years, having consistently contributed $100 per month to your account, your aggregate contributions of $36,000 will be worth $83,226.

Yet, consider the compounding effects if you had increased your savings rate slightly — to $200 or $500 a month? Or if your employer had agreed to match some, or all, of your contributions to further accelerate your savings and the compounding effect? Or if perhaps, rather than a 5% high-yield savings account, you’d found an investment account with a slightly higher return? The effects would be dramatic. At a 7% average annual return rate, for example, contributing the same $100 monthly investment for a consistent 30-year period would increase the value of your account to over $122,700.

Procrastination Has a Price: The Cost of Waiting

Given the importance of time and consistency to the power of compounding, the opportunity cost of delaying your investments by even a few years can equal hundreds of thousands of dollars in the long-term.

Reconsider Alice and Bob. In this instance, Alice invests $300 per month (beginning at the age of 25) in an investment account earning an average annual return of 8%. Bob, however, waits an additional 10 years and does not start investing the same amount into the same investment account as Alice’s until he is 35. When Alice and Bob are both 65, Alice’s investment account will be worth $1,041,000, while Bob’s account will be worth $460,000: Less than half of Alice’s.

$600,000 is an incredibly hefty price to pay for a 10-year delay.

Saving For Your Family’s Life-Cycle Expenses Unlocks Financial Security

Those who are familiar with the concept of compounding and its ability to drive exponential growth regularly consider compounding when planning for retirement. However, as most people start and raise a family well before they retire, it may be helpful to intentionally leverage the magic of compounding to save and plan for family life-cycle expenses. This is particularly beneficial, since the failure to adequately prepare for family life-cycle expenses can, and often does, compromise an otherwise successful retirement savings strategy.

- With only 23% of employees being eligible for paid maternity or paternity leave, Bankrate indicates approximately 50% of women tap, or consider tapping, into their 401(k) or other retirement saving plans prematurely to be able to fund their maternity leave.

- According to The Transamerica Center for Retirement Studies, 30% of parents who were not financially prepared for children needed to withdraw from their retirement savings prematurely, significantly impacting their long-term financial security.

- 77% of parents indicate they’ve made financial sacrifices for their children, according to LendingTree, and 37% have done so by delaying investments or retirement savings.

If maximizing your retirement portfolio requires time and consistency, saving and planning for your family’s life-cycle expenses (while leveraging the power of compounding) can help to provide you with this much-needed time and consistency.

StorkFund Is Your Family Life-Cycle Partner

StorkFund Is Your Family Life-Cycle Partner

StorkFund is designed to empower parents and aspiring parents to effortlessly save for and manage family life-cycle expenses, enabling employees to save directly from their paychecks, in a high-yield savings and/or investment account, with contributions matched by their employer. With a StorkFund:

- Employees Contribute to their StorkFund each paycheck, and

- Employers Match some or all of their employees’ contributions within each paycheck, with

- Investment and Savings accounts available for employees to select, in line with their financial goals and family needs. Funds are

- Accessible as Needed and reserved for family life-cycle expenses, and provided

- Alongside Community, resources, and exclusive discounts provided by trusted fertility, childcare, and other family life-cycle providers.

With StorkFund enabling parents and aspiring parents to leverage the power of compounding, you’ll have the opportunity to increase your long-term financial security, minimize your financial stress, and secure your peace of mind; bringing your best, most whole, and productive self to all areas of life, whether at home or at the workplace.

Don’t Let Misconceptions Delay Your Wealth Journey With StorkFund

If you believe you require a large sum of money to begin contributing, you don’t. Even modest amounts, when invested consistently, grow significantly over time.

If you believe it’s too late for you and your family, it’s not. It’s never too late to start saving and improving your financial health. While saving as early as possible for your family’s life-cycle expenses is ideal, compounding still works whenever and however you begin.

Harness the power of compounding and start saving today with StorkFund for a brighter, more secure future.